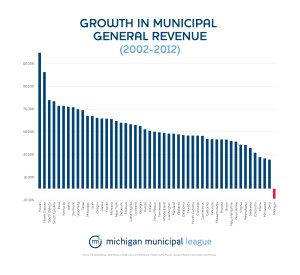

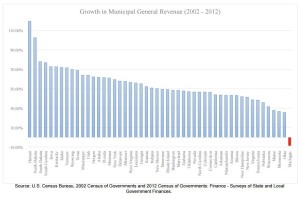

One of the many charts showing how Michigan has disinvested in its cities more than any other state in the state. That tiny red line you see is Michigan. A 2016-17 Senate budget plan would cut statutory revenue sharing to communities even more. Learn more at SaveMiCity.org

The Michigan House and Senate Appropriations committees made their opening moves on the state budget this week by reporting the full budget bills to the floors of their respective chambers. Following expected floor action on these bills in the coming week or two, each chamber will review the other’s proposal and move toward a final budget deal sometime in early June.

Both proposals continue the current practice of ignoring the fiscal needs of local government, failing to make revenue sharing and the larger issue of municipal finance a budget priority. Without a renewed focus and commitment by the Governor and Legislature, Michigan will continue to occupy last place nationally in our treatment of local government. Learn about the League’s municipal finance initiative at SaveMiCity.org. View how much money your community has lost in revenue sharing here.

The House committee reported an omnibus budget bill, House Bill 5294, to the floor which includes funding for revenue sharing. The House proposal maintains current-year funding for revenue sharing, only deviating from the Governor’s original recommendation by maintaining the $5.8 million that the Governor would have removed for approximately 100 townships that hadn’t received revenue sharing previously.

The Senate committee, on the other hand, moved Senate Bill 788 to the Senate floor with significant changes to the Governor’s proposal for revenue sharing. Statutory revenue sharing would see a 1.5% reduction ($3.85 million) in the Senate version, with the dollars from that reduction being shifted to cover a proposed local match requirement for the purchase of new voting equipment. The League urges you to contact your Senator, asking them to join us in opposition to this approach.

In the Governor’s original budget proposal, the effort to replace existing voting equipment statewide was supported by $10 million in General Fund and $5 million in requested (unidentified) local match. These dollars would be coupled with remaining federal Help America Vote Act funds and dollars appropriated for this purpose in the current budget year. The purchase of new voting equipment has been championed by the County and Municipal Clerks Associations and the Secretary of State’s office, but the call for a local match requirement had not been voiced prior to this year’s budget.

The proposal to accommodate the Governor’s local match request in the Senate version raises serious concerns for the Michigan Municipal League and member communities, even beyond the further erosion of an already devastated statutory revenue sharing base.

- All cities, villages, townships and counties would benefit from the purchase of new voting equipment, but the local match requirement would only be paid by those cities and villages and few townships that receive a statutory payment. ***Counties and townships that do not receive non-Constitutional revenue sharing payments would pay no local match.

- By paying the local match only out of the statutory revenue sharing line, there is no correlation to the actual match requirement for equipment being purchased within each community. In a sample comparing similarly sized communities, one with 19 voting precincts would forgo only about $1,500 in revenue sharing, while another community with only 12 polling places would lose more than $22,000 … and this does not account for the more than 1,000 local government units that would pay nothing in local match!

- County statutory payments, already funded at 100%, would receive a 2% increase ($4.3 million) in this proposal. Again, without any requirement for a local match for voting equipment purchases by a county.

- This match requirement would be deducted during the FY 16-17 budget year, yet voting equipment would not be received by any local government until at least 2017 and delivery would like be phased in over two to three years.

Comments have been made that under this proposal, every local unit will receive at least what they received during the current budget year even with the 1.5% base reduction, but this statement assumes that there will be growth in sales tax revenue driving higher Constitutional revenue sharing payments. Early indications from the most recent Senate Fiscal Agency monthly revenue report reveal that it is unlikely that the state will even meet its already reduced sales tax estimate for the current year, let alone meet the overly optimistic 3.9% growth estimate for the coming year. It is more probable that Constitutional revenue sharing payments will be flat for a third year in a row, if not reduced at some point over the next year.

It is expected that the Senate’s revenue sharing plan will be voted on by the full chamber next week. Please remember to contact your Senator and urge them to begin restoring the cuts of the past decade and reform the way local governments are funded. They should start by rejecting the committee proposal.

Chris Hackbarth is the League’s director of state affairs. He can be reached at 517-908-0304 and chackbarth@mml.org.