Staff from the White House Office of Intergovernmental Affairs and the U.S. Department of the Treasury just wrapped up their second local government briefing following today’s release of the Interim Final Guidance for the Coronavirus State and Local Fiscal Recovery program within the American Rescue Plan (ARP) federal stimulus.

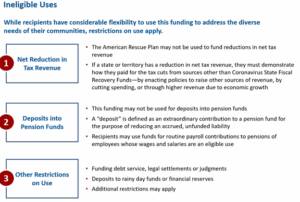

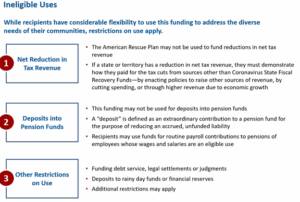

Here are some of ineligible uses of the American Rescue Plan support for municipalities. These were shared Monday as part of a presentation by the U.S. Department of the Treasury during a webinar Monday.

Prior to the briefing, Treasury and the White House offered a Fact Sheet that outlined many of the highlights found within the 150 page guidance document and accompanying initial FAQ. These documents are meant to assist states and local units of government with eligible expenditure opportunities for the stimulus funds.

Administration officials offered insight into many of the goals behind the inclusion of these state and local relief dollars within the stimulus bill, including a desire to blunt many of the negative impacts that the country’s economy experienced due to the contraction in economic activity from state and local governments following the Great Recession. The Administration views the ARP as an opportunity to help states and local governments avoid a repeat of the post-Great Recession years by providing a longer tail of support that will allow local communities to weather any unforeseen shortfalls or economic downturns on the path to recovery.

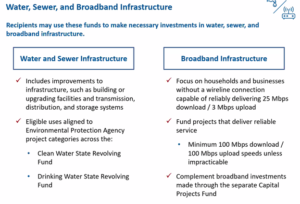

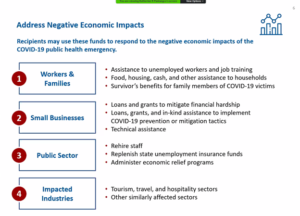

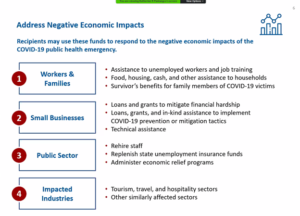

Here are some of eligible uses of the American Rescue Plan support for municipalities. These were shared Monday as part of a presentation by the U.S. Department of the Treasury during a webinar Monday.

The presenters acknowledged the need for continuing work on the guidance and related FAQs in the coming weeks and promised a robust staff response through a call center, a planned series of additional briefings, and other updates and communications with local units of government.

Specific to Non-Entitlement Local Units of Government who will receive their funding on a per capita basis as a pass-through from the state, officials this evening relayed that individual allocations for those non-entitlement units are planned for release next week. While today’s announcement and guidance release identified the overall funds that Michigan will receive for these non-entitlement units ($644.3 million), the individual amounts are delayed while Treasury continues to navigate the unique local government structure in each state.

Tonight’s presentation offered three main focus points as the driving force behind the guidance:

- Fighting the pandemic

- Replacing lost revenues

- Building a foundation for a stronger economic recovery

Here are some of eligible uses of the American Rescue Plan support for municipalities. These were shared Monday as part of a presentation by the U.S. Department of the Treasury during a webinar Monday.

League staff and our partners at the National League of Cities are diving into the guidance documents tonight and over the next few days and we will be scheduling a series of webinars for members to help understand their meaning and opportunities for investment and fiscal relief as these dollars begin to be distributed from Washington.

League members are encouraged to visit US Treasury’s Coronavirus State and Local Fiscal Recovery Funds website for continuing updates and updated FAQs. This website also offers access to the portal for receiving direct payments for those cities classified as Metropolitan Cities according to the Act. The link to the portal can be found here.

Local governments designated as non-entitlement units are eligible to receive Coronavirus State and Local Fiscal Recovery Funds, as provided in the American Rescue Plan Act. However, they will receive this funding from their applicable state government, not though this link.

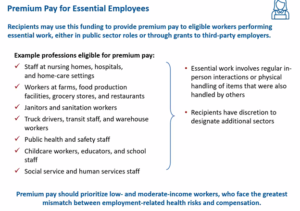

SUBMISSION REQUIREMENTS

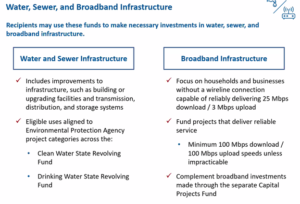

Here are some of eligible uses of the American Rescue Plan support for municipalities. These were shared Monday as part of a presentation by the U.S. Department of the Treasury during a webinar Monday.

To complete a submission on behalf of your jurisdiction, you will be asked to provide the following information:

- Jurisdiction name, taxpayer ID number, DUNS Number, and address

- Authorized representative name, title, and email

- Contact person name, title, phone, and email

- Funds transfer information, including recipient’s financial institution, address, phone, and routing number and account number

- Completed certification document (to be signed by the authorized representative)

Jurisdictions must submit a request to receive funding even if they have previously applied for other programs through the Treasury Submission Portal. Eligible jurisdictions will receive further communications regarding the status of their submission via the email address provided in the Treasury Submission Portal.

Chris Hackbarth is the League’s director of state & federal affairs. He can be reached at 517-908-0304 and chackbarth@mml.org.

John LaMacchia is the Assistant Director of State and Federal Affairs for the League handling transportation, infrastructure, energy and environment issues. He can be reached at jlamacchia@mml.org or 517-908-0303.