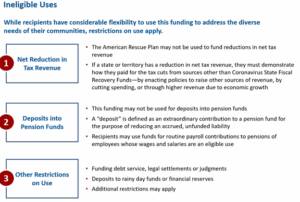

Here are some of ineligible uses of the American Rescue Plan support for municipalities. These were shared Monday as part of a presentation by the U.S. Department of the Treasury during a webinar Monday.

New Update: The National League of Cities (NLC) and the Michigan Municipal League (MML) will each have events about the new guidelines in the coming days. The NLC will have a Federal Advocacy Update Call at 4 p.m. Wednesday, May 12 (register here) and the MML will unpack the guidelines for you during our Live with the League conversation Monday, May 17. Register for that here.

Update: The U.S. Department of the Treasury and the White House Office of Intergovernmental Affairs will host two identical 30-minute introductory briefings with state and local associations and stakeholders TODAY (May 10, 2021) at 4:00 PM EDT (link) and 6:45 PM EDT – (NEW LINK here). The Michigan Municipal League encourages our members to attend.

The U.S. Department of the Treasury today released the guidelines that communities must follow in administering the American Rescue Plan. The Michigan Municipal League and National League of Cities are currently analyzing the guidelines and we will have a webinar very soon to break it all down for you. Keep a close eye on your emails for details on the upcoming webinar.

Here are some of the possible uses of the American Rescue Plan support for municipalities. These were shared Monday as part of a presentation by the U.S. Department of the Treasury during a webinar Monday.

The National League of Cities has sent the MML the following documents detailing the guidelines and allocations. Here are links to those documents:

- Official Guidelines from Treasury – 151 pages

- List of recovery funds by metro cities

- List of recovery funds by county

- List of recovery funds for non-entitlement support by state (Please Note: The State of Michigan is getting $644 million for non-entitlement communities. A list of non-entitlement support by community is coming soon from the Michigan Department of Treasury.)

- Press Release: Treasury Launches Coronavirus State and Local Fiscal Recovery Funds

Here is key information about the guidelines from a U.S. Department of the Treasury Press release.

- Today, the U.S. Department of the Treasury announced the launch of

the Coronavirus State and Local Fiscal Recovery Funds, established by the American Rescue Plan Act of 2021, to provide $350 billion in emergency funding for state, local, territorial, and Tribal governments. Treasury also released details on the ways funds can be used to respond to acute pandemic-response needs, fill revenue shortfalls among state and local governments, and support the communities and populations hardest-hit by the COVID-19 crisis. Eligible state,

territorial, metropolitan city, county, and Tribal governments will be able to access funding directly from the Treasury Department in the coming days to assist communities as they recover from the pandemic. -

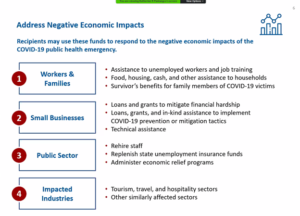

Here are some of eligible uses of the American Rescue Plan support for municipalities. These were shared Monday as part of a presentation by the U.S. Department of the Treasury during a webinar Monday.

While the need for services provided by state, local, territorial, and Tribal governments has increased —including setting up emergency medical facilities, standing up vaccination sites, and supporting struggling small businesses—these governments have faced significant revenue shortfalls as a result of the economic fallout from the crisis. As a result, these governments have endured unprecedented strains, forcing many to make untenable choices between laying off educators, firefighters, and other frontline workers or failing to provide services

that communities rely on. Since the beginning of this crisis, state and local governments have cut over 1 million jobs. - The Coronavirus State and Local Fiscal Recovery Funds provide substantial flexibility for each jurisdiction to meet local needs—including support for households, small businesses, impacted industries, essential workers, and the communities hardest-hit by the crisis. Within the categories of eligible uses listed, recipients have broad flexibility to decide how best to use this funding to meet the needs of their communities.

- In addition to allowing for flexible spending up to the level of their revenue loss, recipients can use funds to:

• Support public health expenditures, by – among other uses – funding COVID-19

mitigation efforts, medical expenses, behavioral healthcare, mental health and substance misuse treatment and certain public health and safety personnel responding to the crisis;

• Address negative economic impacts caused by the public health emergency,

including by rehiring public sector workers, providing aid to households facing food, housing or other financial insecurity, offering small business assistance, and extending support for industries hardest hit by the crisis

• Aid the communities and populations hardest hit by the crisis, supporting an

equitable recovery by addressing not only the immediate harms of the pandemic, but its exacerbation of longstanding public health, economic and educational disparities

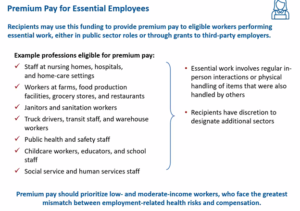

• Provide premium pay for essential workers, offering additional support to those who have borne and will bear the greatest health risks because of their service during the pandemic; and,

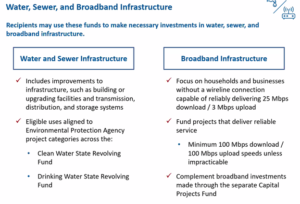

• Invest in water, sewer, and broadband infrastructure, improving access to clean

drinking water, supporting vital wastewater and stormwater infrastructure, and expanding access to broadband internet. - Insufficient federal aid and state and local austerity under similar fiscal pressures during the Great Recession and its aftermath undermined and slowed the nation’s broader recovery. The steps the Biden Administration has taken to aid state, local, territorial, and Tribal governments will create jobs and help fuel a strong recovery. And support for communities hardest-hit by this crisis can help undo racial inequities and other disparities that have held too many places back for too long.

- For more information, visit Coronavirus State and Local Fiscal Recovery Funds on

Treasury.gov.

Here are some of eligible uses of the American Rescue Plan support for municipalities. These were shared Monday as part of a presentation by the U.S. Department of the Treasury during a webinar Monday.

Now that these long-awaited guidelines for the State and Local Fiscal Recovery Funds are out, the Michigan Municipal League anticipates that many of our member communities will likely get contacted from the media, businesses, and residents about how they are going to utilize this support within these guidelines.

To help, the League has come up these talking points for our community leaders to use if they would like. The talking points are also pasted below.

Also, the ServeMICity program generously supported by the Michigan Municipal League Foundation is there to help your community navigate all COVID-19-related financial assistance that’s out there, including these ARP dollars. If you are interested in that program please contact the League’s Shanna Draheim at sdraheim@mml.org.

If you have any questions about these talking points or the American Rescue Plan in general, please contact the League’s Chris Hackbarth at chackbarth@mml.org, John LaMacchia at jlamacchia@mml.org, or Matt Bach at mbach@mml.org.

Please stay tuned to the League’s Inside 208 blog and the League’s social media outlets for the latest information about the American Rescue Plan, including upcoming informational webinars, videos, and discussions that the League is currently working on related to these guidelines.

Here are the talking points (get printable pdf here):

Charting Our Future: ARP Talking Points

- After weeks of waiting and speculation, the guidelines for the American Rescue Plan (ARP) have now been released.

- This support represents a once-in-a-generation opportunity for [MUNICIPALITY] to reflect on the needs of our community and strategically invest these resources in our future, building community wealth for our residents and businesses.

- Our community is currently reviewing the new American Rescue Plan guidelines and will continue to be deliberate and collaborative in deciding how to best use this funding in ways that are impactful and have long-term benefit for [MUNICIPALITY].

- To maximize the impact, we will also work with our partners at the Michigan Municipal League and National League of Cities to explore ways to leverage and amplify the funding we have received with other available resources.

- The good news is, we have time, and don’t need to rush our decision on how we spend these funds. A key part of the American Rescue Plan is that the estimated money we are to receive does not have to be allocated until the end of 2024. Providing us the time to work with you to determine how this support is best utilized.

- Our community, like all Michigan municipalities, has faced tough times and tough decisions over the past two decades. The American Rescue Plan gives us an opportunity invest in ourselves, and emerge from the pandemic stronger than we were before.

- This community has stepped up time and time again to find creative, innovative ways to move us forward.

- Michigan communities have endured through [Insert your own examples, such as population decline, once in a lifetime flooding, infrastructure failure, social and racial unrest, economic devastation, major demographic shifts, drug epidemics, declining public health—both physical and mental—] topped off by a global pandemic that threatened to bring us to our knees. We wish we could say that was the end of the list.

- Together, we have risen to the occasion to help each other, and to keep the wheels turning on the basics of local government (public safety, roads and infrastructure, parks, etc.). While the pandemic might be global, its affects are felt locally.

- Many of us have lost loved ones and friends.

- Our restaurants and small businesses have suffered tremendously.

- Our children and schools have struggled to adapt to remote learning.

- In short, now is the time to invest in the needs of our community.

- Local government belongs to its residents. By working together, we will create a plan that responsibly invests in our people and our overall economic recovery while also paying dividends long into the future.