Since their return from Spring Break last month, the House and Senate budget subcommittees have been working to finalize their respective versions of the state budget for every state department and program for the upcoming FY21-22 state fiscal year. Those budget subcommittees recently released their proposed spending plans and they are now being considered by the full Appropriations committees in each chamber before they will cross to the opposing chamber for further consideration and conference committee discussions, which are expected following the state’s May Consensus Revenue Estimating Conference scheduled for Friday, May 21st. These House and Senate proposals are being developed in response to the Governor’s Executive Budget recommendation released earlier this year.

The League has been extremely active on a number of key state budget components, especially revenue sharing and transportation funding, among other municipal priorities. None of the proposed budget versions described below have been negotiated with the other chamber or with the Whitmer Administration and a final budget agreement, expected prior to the summer recess, will look extremely different as all three sides negotiate for their priorities.

In the House:

The General Government budget for FY 21-22 funds a number of state departments, including revenue sharing and the Treasury department and the Labor & Economic Opportunity department (MEDC) spending. This spending proposal is being developed within House Bill 4398.

- The House proposal provides a 1% increase ($2.6M) to statutory revenue sharing as opposed to the Governor’s recommendation for a 2% increase ($5.2M).

- The House language would also require any increased CVTRS revenue sharing a community received that is “underfunded” on their pension system to spend any increase from revenue sharing on their pension system.

- Additionally, the House has added new language that would require all cities, villages, townships, and counties to maintain the same level of public safety funding as their prior budget had expended as a condition for receiving statutory revenue sharing.

- Following a League request, the bill does include $290,000 to restore August revenue sharing payment losses for any community that was unable to utilize the CARES funding they received as a replacement for the stricken August CVTRS payment last year. Also included is a $245,000 line item that we had requested to provide for a restoration of any forfeited revenue sharing payments due to a community missing the December 1, 2020 “dashboard” reporting and certification requirement, so long as the certification was submitted by February 1, 2021.

- The Governor’s recommendation of $40M for shoreline erosion grants for the coming budget year were referenced in this bill with a $100 placeholder amount. As an alternative approach, the House did propose funding that $40M in recommended spending for shoreline erosion in their current year budget supplemental proposal (HB 4420) which is outlined later in this article.

- The House version did not include the Governor’s recommended $5M recommendation for grants to local units for recruiting and training first responders.

- This bill does also not include the Governor’s recommendation for $10M to be deposited into MSHDA’s Housing and Community Development Fund and reduces the Business Attraction and Community Revitalization line items by $5.9M.

- The House version does insert an additional $500,000 into the Rural Jobs and Capital Investment Fund for a total line item of $1.5M.

The House proposal for the Michigan Department of Transportation budget is outlined in House Bill 4409. While the overall revenue available to the State Trunkline Fund is expected to stay relatively flat for the coming year, balancing lower gas tax and vehicle registration fee revenue against the full $600M earmark from the state income tax and expected higher federal aid opportunities, the following items are important for local road agencies:

- Local road agencies are estimated to receive an additional $52.8M through their PA 51 distribution.

- The House version agrees with the Governor’s recommendation to restore $12.8M to the Transportation Economic Development Fund and a $3M restoration to transit agencies through the Comprehensive Transportation Fund.

- The House adds a $226M line item aimed at local road and bridge repair and replacement, and a new program funded with $374M designed to repay existing transportation bond debt.

The House Environment, Great Lakes, & Energy Department budget proposal for next year (HB 4397) did include the Governor’s recommendation of $15M for responding to dam safety emergency issues, but the House did not fund the $20M one-time recommendation for contaminated site clean-ups or the Governor’s $290M MI Clean Water Plan proposal. The House also included a one-time allocation of $25M for PFAS clean-up and other emerging contaminates.

In the Senate:

Their General Government budget proposal is included in Senate Bill 82 –

- The Senate proposal agreed with the Governor’s recommendation on statutory revenue sharing by funding a 2% ($5.2M) CVTRS increase. Additionally, the Senate builds this 2% directly into the CVTRS base, where the Governor’s recommendation had this 2% increase listed as one-time.

- The Senate maintained the current requirement that any CVTRS increase amount must be dedicated to an unfunded pension liability for any community identified as “underfunded” under PA 202.

- Based upon the League request, the bill also includes $433,000 to restore August revenue sharing payment losses for the more than 100 cities, villages, townships, and counties that were unable to utilize the CARES funding they received as a replacement for the stricken August CVTRS payment last year.

- The Senate did not include the Governor’s $5M recommendation for local first responder recruitment and training grants, but they did include a $50M 100% matching grant program for any community with a pension system funded at less than 40% that makes an accelerated payment towards that unfunded liability.

In the Senate LEO budget for the coming year (SB 85) the Governor’s recommendation for $10M in MSHDA’s Housing and Community Development Fund was not included. The subcommittee did recommend an additional $15M for Pure Michigan and increased Arts and Cultural grants by $1.5M above the Governor’s recommendation.

In their EGLE budget proposal (SB 91), the Senate subcommittee included $15M for dam safety and put $10M towards high water and shoreline erosion grants, but declined to fund the $290M MI Clean Water Plan or the $20M recommendation for contaminated site clean-up.

The subcommittee recommendation for the MDOT budget is detailed in SB 92. The Senate included the Governor’s recommendation for increasing local road fund through the MTF by $52.8M and supported the restoration of last year’s cuts to the TEDF ($12.8M) and transit agencies within the CTF ($3M).

In addition to the work on the budget for the upcoming state fiscal year, each chamber is discussing competing proposals to spend portions of the December federal stimulus funding and the recently passed American Rescue Plan Act stimulus. These supplemental budget appropriations would apply to spending in the current state fiscal year and represent very different approaches from the two chambers. The Administration has issued their recommendations for the spending of the December federal stimulus, but await forthcoming US Treasury guidance before making detailed ARPA spending recommendations.

The House has two General Fund related supplemental budget bills on the House floor awaiting further action. House Bills 4419 and 4420 propose approximately $6 billion in new, non-education spending for the current budget year. Highlights from the two House bills that would impact local governments include:

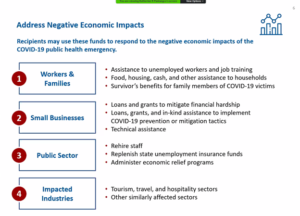

- HB 4419 would pass through the anticipated $686M in ARPA funds that are designated for the “non-entitlement” local units of government. Pending the disbursement of those funds from the federal government to Michigan.

- The bill also includes $103M in federal LIHEAP funding, $378M from the December stimulus proposal for rental and utility assistance and housing stability services, $68M for airports, $65M of federal funds for local road agencies, and $76M for rural transit agencies.

- HB 4420 moves federal dollars into a number of state GF/GP line items to free up those GF/GP dollars. The bill then appropriates those state GF dollars into a host of different programs and lines.

- This bill puts $350M into the state’s rainy day fund. It directs $40M into high water and shoreline erosion grants and $25M for PFAS remediation and $25M for contaminated site cleanup grants.

- The bill fully funds the state’s Flint water settlement, appropriating $595M versus the annual $35M bond debt service that is currently planned. Along the same lines, the bill invests $74M into State Trunkline Fund bond repayment and another $626M into a new Transportation Bond Repayment Sinking Fund.

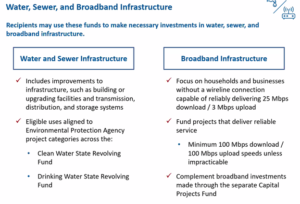

- Additionally for infrastructure, this bill would spend $250M for natural gas infrastructure expansion, $150M for broadband expansion, $250M for water and sewer replacement grants, and $300M for local road and bridge replacement and repair.

The Senate’s supplemental budget bill for the current year (SB 36) focuses mainly on appropriating the remaining December federal stimulus funds. The only ARPA dollars in this bill are related to anticipated day care funding the state expects to receive from the March federal bill. This bill is also on the Senate floor awaiting further action.

- SB 36 appropriates the $378M federal emergency rental and utility assistance dollars allocated to Michigan. $46M of additional FEMA disaster assistance.

- Of the transportation funds the December stimulus allocated to Michigan, the Senate proposes a statute change that would allow all of the dollars coming into Michigan to be distributed solely to cities, villages and counties. Under this proposal, cities and villages would receive $93.5M and counties would get $167.8M. State trunklines would not receive any of these stimulus dollars.

With additional federal guidance on ARPA expected in the next week and the state’s May revenue estimating conference scheduled for later this month, most of the upcoming budget activity will likely focus on positioning the budget and supplemental bills for final negotiations between legislative leadership and the governor.

Chris Hackbarth is the League’s director of state & federal affairs. He can be reached at 517-908-0304 and chackbarth@mml.org.